Dear Investors,

Another week of whiplash in the markets—tariffs, AI disruption, and gold rallies. But beneath the noise, opportunities are beginning to separate from the chaos. Here's how we see the field from both the CEO and CIO chairs.

___________________________________________

THE OPINION

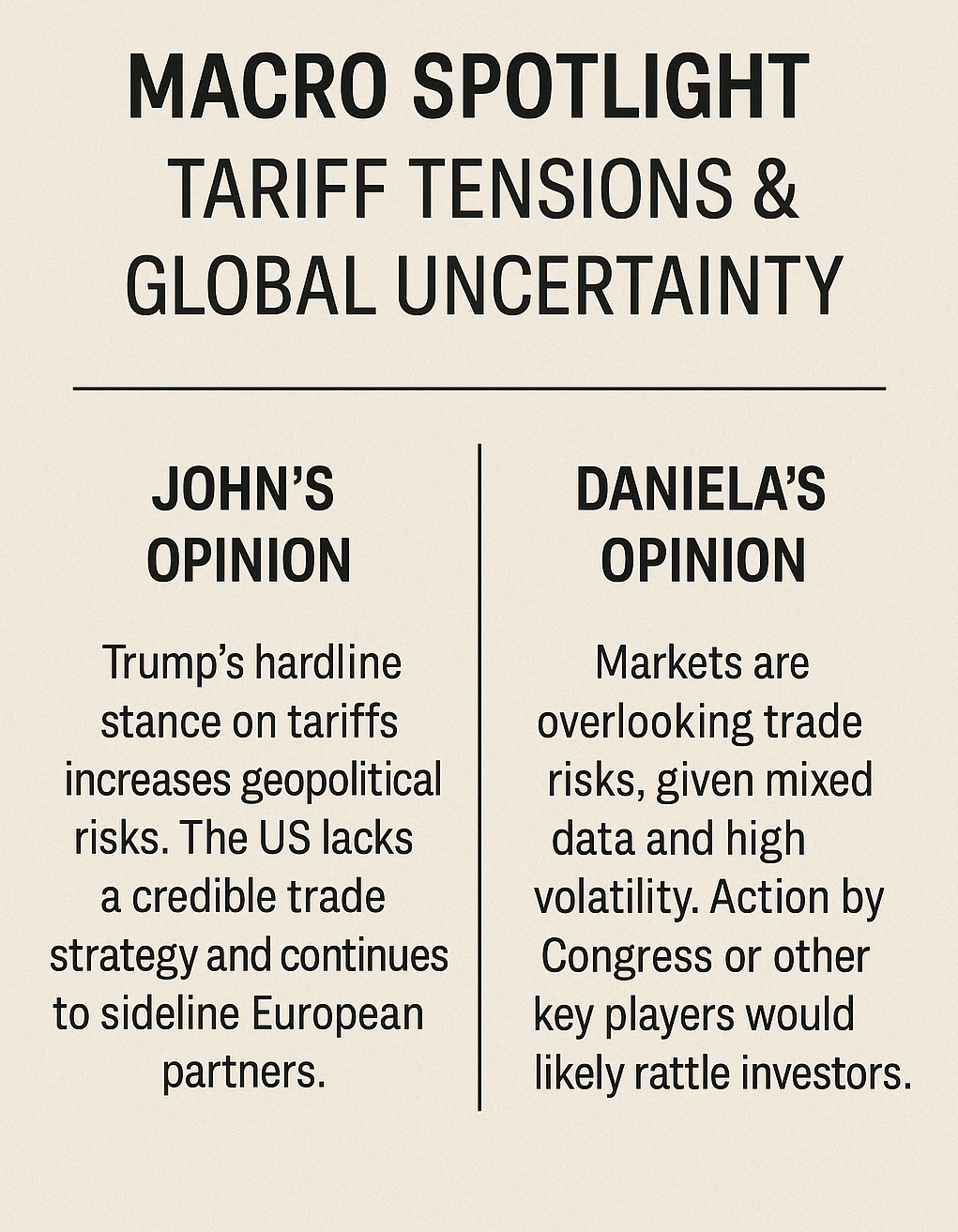

🌍 Macro Spotlight: Tariff Tensions Escalate

Trump’s “no rush” stance adds new fog to global trade priorities. Europe and Canada left in limbo.

Exit France ($EWQ) and Canada ($EWC).

Maintain barbell:

✅ Long reshoring (industrial automation, logistics).

✅ Tariff-resistant consumer staples.

Daniela (CEO): “We’re not waiting for policy clarity—we’re preparing for it. This is when strategic patience gets rewarded.”

John (CIO): “Tariffs distort capital allocation. Our job is to front-run that distortion and own what gains from it.”

💰 Liquidity Check: Buffett’s $300B Signal

Berkshire sits on $300B+ cash—the highest ratio since 1998.

Portfolio Moves:

Keep T-bills and cash as active weapons, not idle.

Track Berkshire moves for sentiment shifts.

Daniela: “Cash isn’t just a defense—it’s optionality in a world that’s mispriced.”

John: “Buffett is telegraphing something. Liquidity is signal. He’s telling us it’s not time… yet.”

🛡 Gold’s Breakout: A Fear Signal

Gold rockets past $3,200 amid fear and flight-to-safety flows.

Portfolio Moves:

5–7% gold allocation via GLD or royalty plays.

Use 1×2 call spreads to play volatility.

Daniela: “This is a message from the market: fear is now a currency. Gold is the translation.”

John: “We hedge with elegance. A well-structured 1×2 call spread pays you for that fear spike.”

🤖 AI Wars: DeepSeek’s Rise vs. U.S. Giants

China’s DeepSeek-R1 makes waves. U.S. AI dominance is not unchallenged.

Portfolio Moves:

Stick with infra leaders like NVDA, TSM ADR.

Add selective EM AI integrators as hedges.

Daniela: “AI is no longer just about models—it’s about platforms and ecosystems. We bet on infrastructure.”

John: “DeepSeek is the open-source Huawei moment. It’s not hype—it’s a hedge we’re watching.”

⚠ VIX Hits 60: Market’s Warning Shot

Volatility is back. Internals are extreme.

Portfolio Moves:

Staggered June/August downside collars.

Fund hedges with covered calls on recent gainers.

Daniela: “This isn’t fear—it’s recalibration. We prepare for movement, not paralysis.”

John: “Volatility is a tax or a tool depending on how prepared you are. We choose the latter.”

🔍 Small Cap Value: A Quiet Shift

We may be seeing the start of a leadership rotation—like post-dotcom.

Portfolio Moves:

Evaluate high-quality Small Cap Value (P/Es as low as 1x–2x).

Build positions selectively.

Daniela: “This is where real alpha hides—under-followed, unloved, and undervalued.”

John: “The best trades don’t shout. Small Cap Value is whispering—listen carefully.”

🚨 Bubble Watch: Retail & Expensive Tech

COST & WMT at record valuations. Tech names at unsustainable P/Es.

Name | Forward P/E |

|---|---|

COST | 56x |

WMT | 38.6x |

ISRG | 73x |

ARM | 97x |

CRWD | 100x |

AXON | 116x |

TEAM | 84x |

MDB | 91x |

PLTR | 186x (PEG: 7x) |

Take profits or hedge these names.

Expect near-term corrections, especially in retail.

Daniela: “Valuation discipline isn’t optional—it’s survival. Retail darlings are pricing in perfection.”

John: “This is where bubbles pop quietly. First the multiple, then the narrative.”

What advice would you give?

Daily swings of 5–10% make big directional bets a liability. We focus on flexible positioning, strong liquidity, and deep value.

Our playbook:

Stay nimble.

Embrace liquidity as offense.

Own assets with asymmetry—where downside is limited, and upside is misunderstood.

This isn’t chaos. This is the pivot point. The world is reshaping — and Linda AGI is ahead of the curve. Stay focused. Stay bold.

You're reading the most important email you'll get this Friday. Let’s keep winning — together.

Warm regards,

Daniela & John

Linda AGI – Macro & Markets Team

▶ Was this email forwarded to you?