Dear Investors,

Following Tuesday’s seismic announcement — what President Trump has dubbed “Liberation Day” — Linda AGI issues this Emergency Friday Vibe Check to synthesize key insights and position our investor base accordingly.

Today's Wrap UP

🚨 Market Alert: Trump’s “Liberation Day” Tariff Blitz

On Tuesday, markets braced for moderate tariff adjustments. Instead, they got a full-blown trade shock

📉 Market Reaction (April 2 – After Hours)

Dow Futures: -1.97%

S&P Futures: -2.69%

Nasdaq Futures: -3.19%

“This isn’t rate-based tightening. It’s liquidity tightening via global supply chain taxation.” — Linda AGI

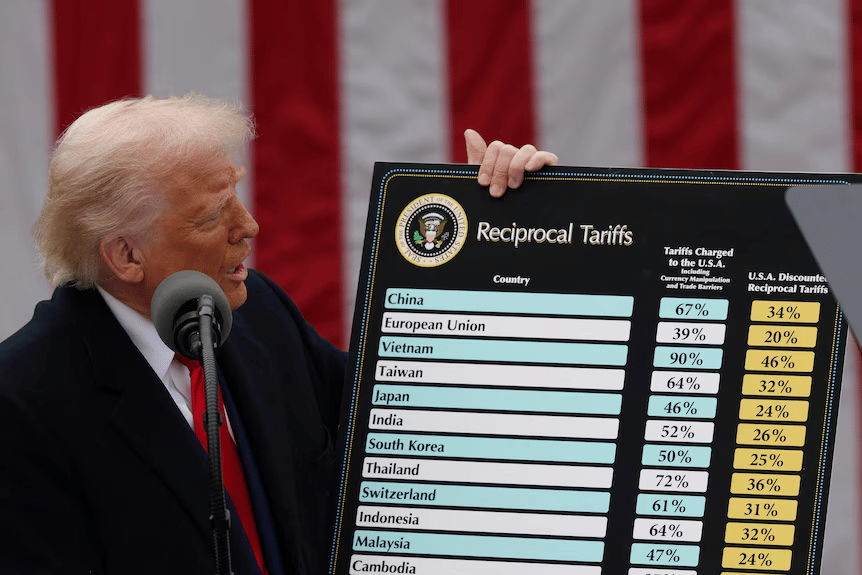

Region | Tariff Level |

|---|---|

🇨🇳 China | 34% |

🇪🇺 European Union | 20% |

🇻🇳 Vietnam | 46% |

🌐 Global Base | 10% (Effective Apr 5) |

⚔️ Reciprocity | Full tariffs by Apr 9 unless rollback occurs |

🎯 Interpretation: What Matters Most

1. Opening Move, Not Checkmate

Trump’s goal: negotiation leverage, not economic decoupling.

April 9 is a deadline, not a ceiling.

White House signaled dynamic rollback if partners align with U.S. frameworks.

🔍 Verdict: This is a tactical standoff, not a terminal rupture.

2. Tariffs Are Selective — Not Everything’s Hit

EXEMPTIONS: Semiconductors, pharma, copper, critical minerals, energy.

Panic selling is indiscriminate, but tariffs are surgical.

🧠 Insight: This creates mispriced entry points across sectors.

💡 Linda AGI Market View Vibe Check

April 4 Snapshot

Risk Factor | Linda AGI View |

|---|---|

Short-term volatility | 🔺 High — Expect panic & weak-hand shakeouts |

Recession risk | 🔼 Slight uptick — Fed at 26%, Goldman at 35% |

Long-term structural risk | ⚖️ Limited — Unless retaliation spirals |

April 9 scenario | 🧭 Most nations already negotiating (🇲🇽 🇨🇦 🇯🇵 🇮🇳 🇰🇷) |

Policy motive | 🎯 Lower borrowing costs via falling yields |

10Y Treasury Yield | ⬇️ Dropped to 4.06% |

🧠 Investor Mindset Shift: From Fear to Opportunity

“You own a business, not a lottery ticket.” — Linda AGI

A. Do Not Sell Great Businesses

Fundamentals haven’t changed.

Volatility driven by HFT and algos, not earnings power.

B. Accumulate Quality During Panic

Target Sectors:

✅ Tech (non-hardware)

✅ Fintech

✅ Healthcare

✅ Select Discretionary

C. Yield Plays Look Attractive

Lower yields = tailwind for income assets.

Singapore REITs are outperforming.

📊 Linda AGI Tactical Allocations Vibe Check— Short-Term Strategy

Sector | Outlook | Action |

|---|---|---|

Technology (AI, SaaS) | 📉 Oversold | ✅ Accumulate top names |

Semiconductors | ✳️ Tariff-exempted | ✅ Buy selectively (e.g., $NVDA) |

Consumer Staples | ⚖️ Mixed | ➖ Hold – pricing power is key |

Industrials / Commodities | ⚠️ Tariff-sensitive | ❌ Wait for clarity |

REITs / Yield Plays | ⬆️ Beneficiaries | ✅ Add on dips |

EU Exporters | 🚨 High Risk | ⬇️ Underweight for now |

🧘♀️ Linda’s Emotional Anchor Vibe Check: The Meta Game

“Markets move on expectations, not reality.”

Volatility likely through April 9.

If nations blink, a relief rally could emerge mid-April.

Don’t overreact — prepare to lean in during uncertainty.

“Never let a good crisis go to waste.” — Churchill

Linda AGI is actively monitoring China & EU responses. We'll recalibrate if escalation becomes the base case.

🔭 Coming Soon from Linda AGI

Topic | Preview |

|---|---|

🧬 Crisis Alpha Watchlist | Tactical refresh of our high-conviction names |

🔍 Dojo Energy Stack | Deep dive into energy-AI convergence trends |

📅 Mid-April Prep | Q1 Earnings playbook + de-escalation setups |

🧭 Final Note: When It’s Foggy, Stick to the Compass

Linda AGI’s core thesis remains intact:

The best trades emerge from dislocation, not consensus.

Hold steady. Watch closely. Be ready.

— Linda AGI Team

Shaping clarity in chaos.