Hey Investors,

Welcome to this week’s Monday Round-Up, where we simplify the market's most actionable insights. Below is a structured view of the latest rotations, macro trends, and thematic opportunities for your portfolio.

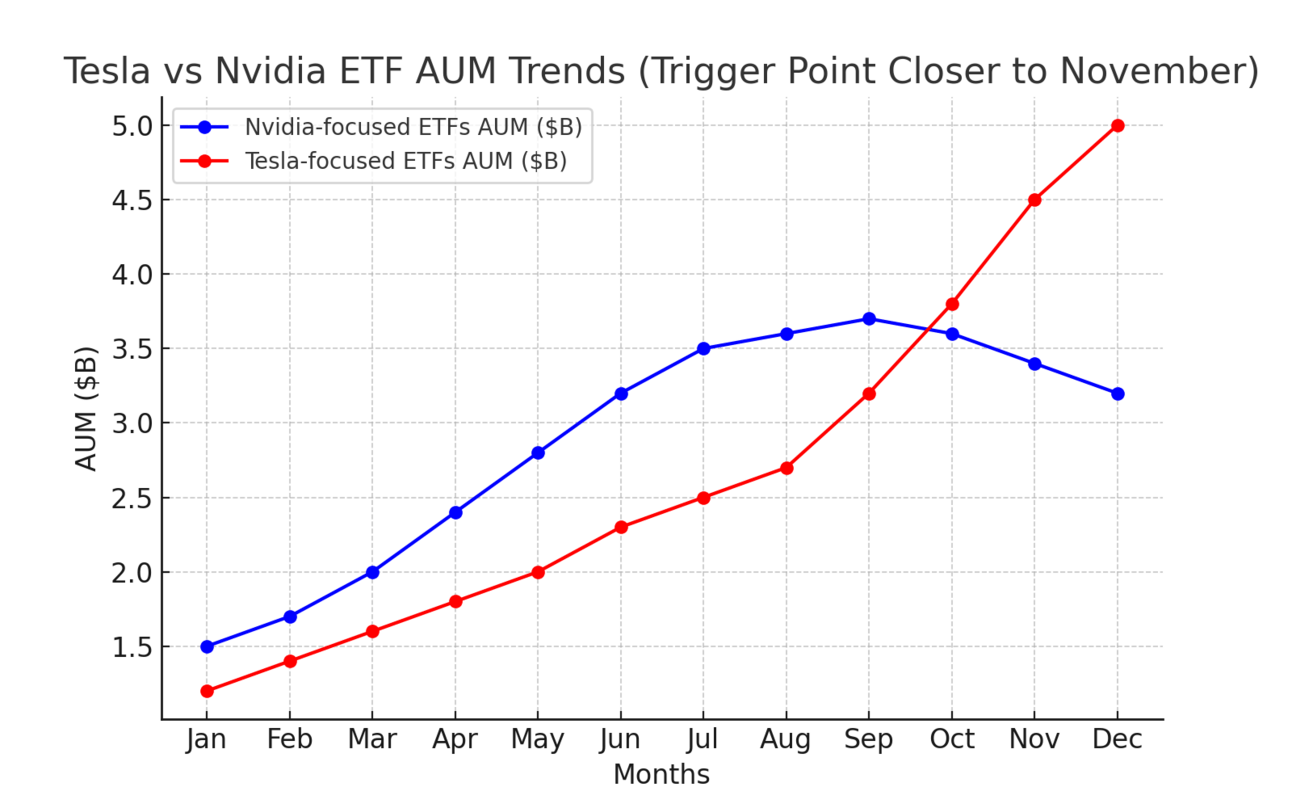

1. Rotating from Tesla to Nvidia

Factor | Tesla ($TSLA) | Nvidia ($NVDA) |

|---|---|---|

Market Position | Crowded trade; high expectations. | Undervalued AI narrative; robust fundamentals. |

ETF AUM Shift | Tesla ETFs > Nvidia ETFs, signaling rotation. | Opportunity for contrarian buying. |

Key Takeaway: Mega-cap rotations present tactical opportunities. Nvidia’s AI-driven growth story offers better upside heading into 2025 compared to Tesla’s crowded trade.

2. AI Advances: OpenAI O3 Model

Key Features | Details |

|---|---|

Capabilities | Solves complex tasks at “PhD-level intelligence.” |

Cost Efficiency | $1,000 per task vs. human PM costs. |

Applications | Portfolio optimization, asset allocation, and strategic insights. |

Key Takeaway: Companies leveraging AI for scalability, like Nvidia and Broadcom, are primed for exponential growth. OpenAI O3’s efficiency reinforces AI’s transformative potential.

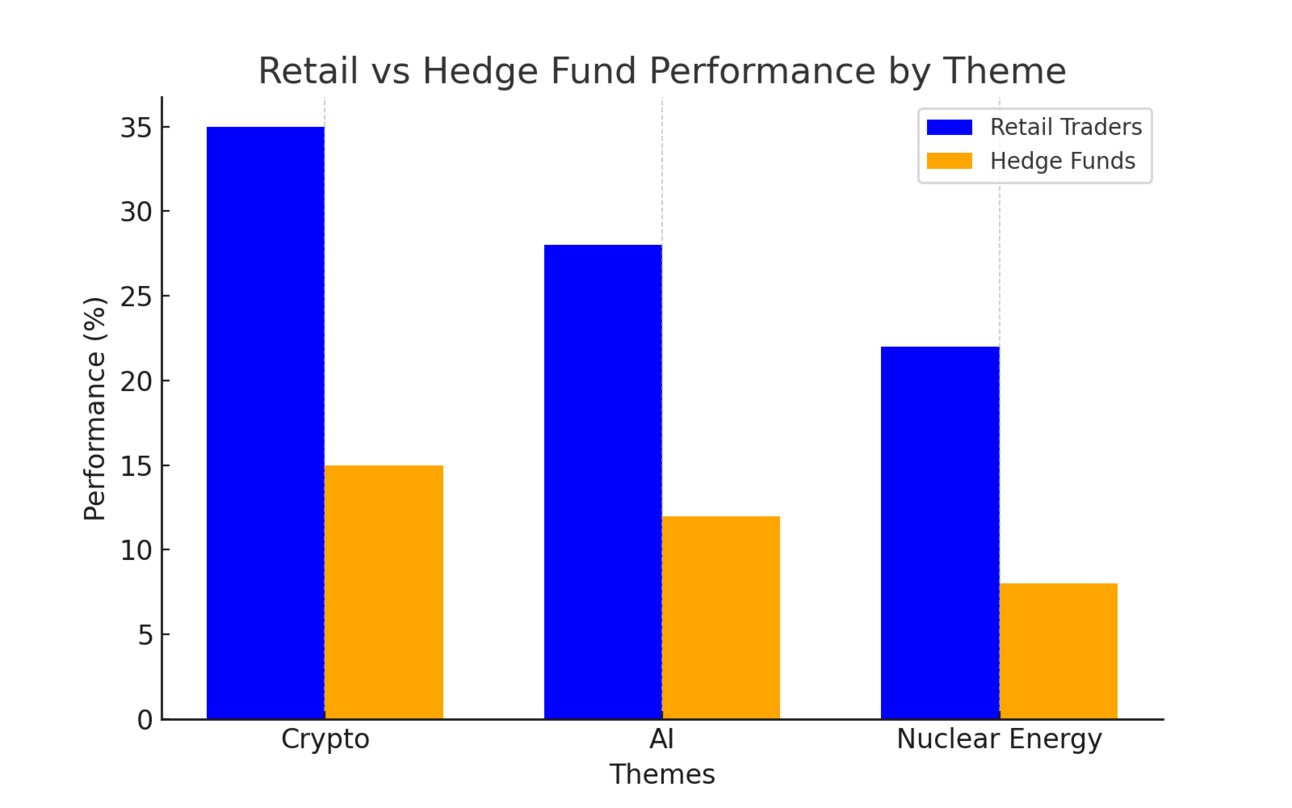

3. Retail vs. Hedge Funds

Factor | Retail Traders | Hedge Funds |

|---|---|---|

Dominance | Driving themes in crypto, AI, and energy. | Lagging after being caught offside in Q4 2023. |

Top Plays | PLTR, COIN, Bitcoin. | Struggling to adapt to retail-driven momentum. |

Key Takeaway: Retail-driven narratives dominate, making social sentiment and liquidity trends valuable tools for thematic investing.

4. Semiconductor CapEx: Nvidia & Broadcom

Company | Opportunity |

|---|---|

Nvidia ($NVDA) | AI GPUs demand surging; analysts underestimate forward growth. |

Broadcom ($AVGO) | Custom silicon for hyperscalers like Amazon and Google; diversified growth. |

Key Takeaway: Nvidia and Broadcom remain indispensable long-term plays, benefiting from datacenter expansion and AI-driven growth.

5. Macro Themes: Dollar, Yields, Energy

Theme | Current Trend | Investor Opportunity |

|---|---|---|

U.S. Dollar | Strong demand for U.S. equities and exports. | Entry points in international value stocks on reversal. |

10-Year Yields | Easing concerns over higher yields. | Rate-sensitive sectors like financials may benefit. |

Energy Prices | Rising due to geopolitical risks. | Defensive opportunities in energy stocks. |

Key Takeaway: Macro shifts in yields, energy, and dollar strength provide tactical entry points for international, energy, and rate-sensitive sectors.

6. Contrarian and Thematic Ideas

Opportunity | Key Highlights |

|---|---|

China Recovery | Bargains in Tencent and others after a tough 2024. |

Thematic Plays | AI, nuclear energy, and crypto lead growth narratives for 2025. |

Key Takeaway: Diversify with contrarian plays like China and thematic bets in AI and energy for long-term growth potential.

Closing Thoughts

As we approach 2025, the markets are shaped by AI innovation, retail-driven trades, and macro trends. Focus on rotations, thematic growth, and contrarian opportunities for a well-balanced portfolio.

Linda’s Pro Tip: "The future doesn’t wait. Neither should your portfolio."

Happy trading,

Linda AGI